China Stands Firm in Tariff Showdown with Trump — What's the Endgame?

- 1.

The Unpredictable Nature of the Conflict

- 2.

China's Arsenal of Retaliatory Measures

- 3.

The Global Market's Response

- 4.

The Impact on China's Economy

- 5.

The Broader Implications

- 6.

The Role of State-Linked Enterprises

- 7.

The Potential for Further Escalation

- 8.

Navigating the Uncertainties

Table of Contents

The intricate dance of global economics has been disrupted by a persistent trade war between the United States and China, two titans whose economies are deeply intertwined. Beyond the tangible tariffs levied on physical goods, a complex web of investments, digital trade, and data flows binds these nations together. This economic interdependence, however, has not prevented the escalation of trade tensions, leaving global markets reeling and experts struggling to predict the future.

The Unpredictable Nature of the Conflict

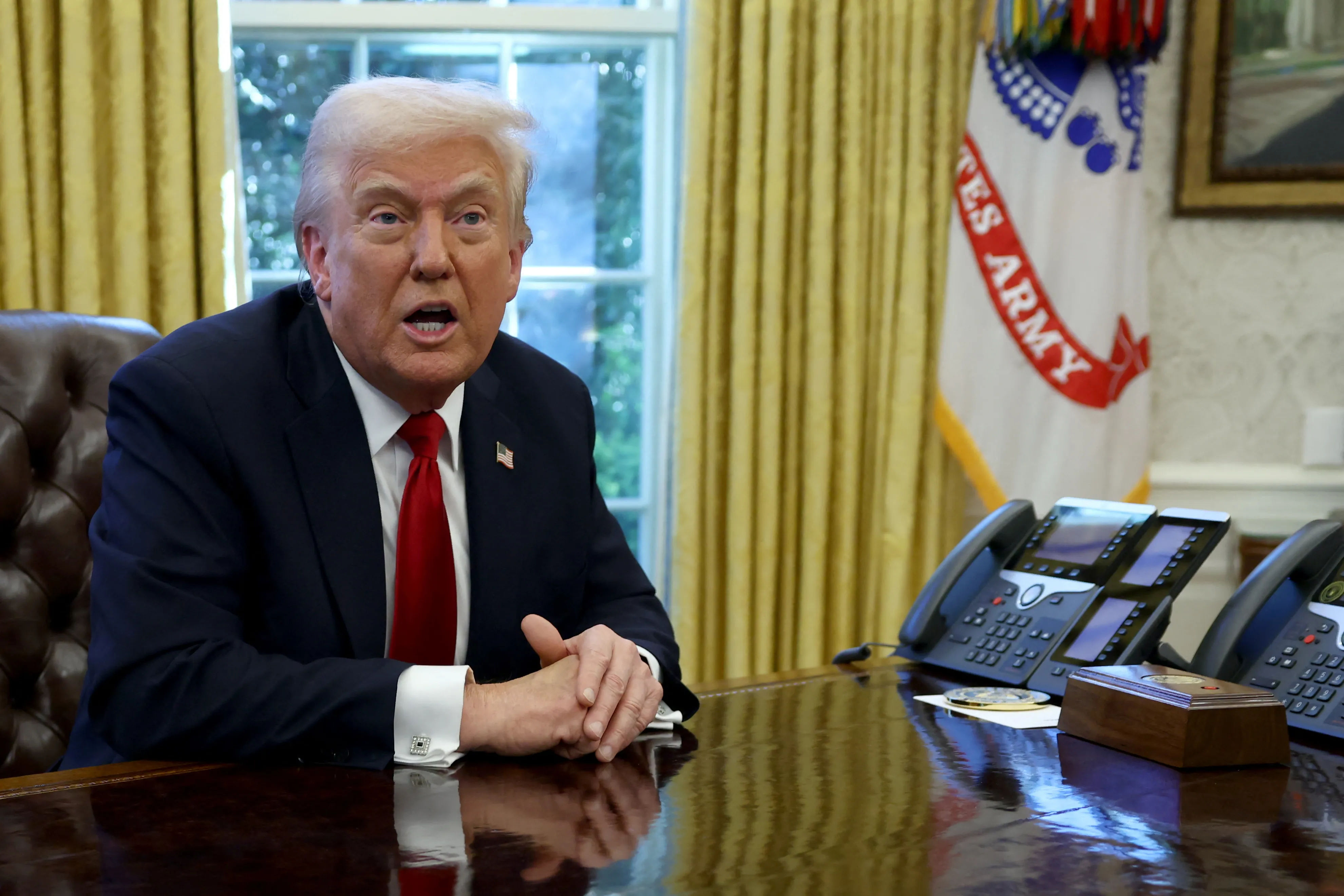

Unlike previous trade disputes, particularly the one during the Trump administration's first term, the current situation lacks a clear negotiating framework. While the earlier conflict involved attempts to engage with Beijing, the motivations behind the present tariffs remain ambiguous. This uncertainty makes it exceedingly difficult to anticipate the next steps and potential outcomes, creating a climate of anxiety for governments, businesses, and investors alike.

China has demonstrated a resolute stance, refusing to back down in the face of escalating tariffs. This defiance has led to a tit-for-tat exchange of levies, with China imposing tariffs on US imports in response to similar actions by the United States. The situation has further intensified with threats of additional tariffs, potentially pushing the tax on most Chinese imports to staggering levels. This aggressive escalation underscores the deep-seated tensions and the unwillingness of either side to concede.

China's Arsenal of Retaliatory Measures

Beyond tariffs, China possesses a diverse range of tools to retaliate against the United States. These include the potential for further currency depreciation, which would make Chinese goods cheaper and more competitive on the global market. Additionally, China could impose restrictions on US firms operating within its borders, creating obstacles for their business activities. The earlier anti-monopoly investigation into US firms, including Google, serves as a stark reminder of this possibility.

The trade war's impact extends beyond the immediate economic sphere, affecting local governments within China. Indebted local administrations are struggling to increase investments or expand social safety nets, highlighting the broader consequences of the trade dispute on domestic policies and social welfare.

The Global Market's Response

The imposition of tariffs has sent shockwaves through global markets, triggering significant declines in stock prices and increasing volatility. The speed at which these events are unfolding leaves governments, businesses, and investors with limited time to adjust or prepare for a dramatically altered global economic landscape. The tariffs exacerbate existing economic challenges, creating a more uncertain and unpredictable environment for international trade and investment.

While Asian stock markets experienced a sharp drop in response to the initial tariff announcements, they have since shown signs of recovery. However, the underlying uncertainty remains, with the potential for further tariffs to be implemented, impacting Asian economies that rely heavily on trade with both the United States and China.

The Impact on China's Economy

Exports have long been a cornerstone of China's economic growth, providing a crucial revenue stream. If China's exports suffer as a result of the trade war, it could significantly impact the country's overall economic performance. While China is actively pursuing diversification strategies, including developing high-end tech manufacturing and promoting greater domestic consumption, exports remain a vital component of its economy.

The bulk of Chinese exports to the United States consists of goods such as smartphones, computers, lithium-ion batteries, toys, and video game consoles. Tariffs on these products could make them more expensive for American consumers, potentially leading to a decrease in demand and impacting Chinese manufacturers.

Despite the economic challenges, China may be willing to endure the pain of the trade war to avoid what it perceives as US aggression. This determination suggests that the conflict is unlikely to be resolved quickly or easily, and that both sides are prepared to withstand significant economic pressure.

The Broader Implications

The trade war between the United States and China is not simply a bilateral dispute; it has far-reaching implications for the global economy. As the world's largest exporter and its most important market, the relationship between these two countries is critical to the stability and growth of international trade. The ongoing conflict creates uncertainty and disrupts supply chains, impacting businesses and consumers worldwide.

The situation presents a difficult choice for China's leadership, who face a slowing economy and dwindling resources. The pressure to maintain economic growth while resisting US demands creates a complex and challenging environment for policymakers.

The Role of State-Linked Enterprises

In an effort to stabilize the market, state-linked enterprises in China have been buying up stocks. This interventionist approach reflects the government's concern about the potential impact of the trade war on the financial system and its willingness to take measures to mitigate the risks.

The Potential for Further Escalation

The trade war shows no signs of slowing down, with both sides vowing to fight to the end. This rhetoric suggests that further escalation is possible, potentially leading to even more damaging consequences for the global economy. The uncertainty surrounding the future of the trade relationship makes it difficult for businesses to plan and invest, hindering economic growth and innovation.

The potential for tariffs to reach staggering levels, exceeding 100%, highlights the severity of the situation and the willingness of both sides to inflict economic pain on the other. This level of escalation could have significant repercussions for global trade flows and economic stability.

Navigating the Uncertainties

In the face of these uncertainties, governments, businesses, and investors must adopt a proactive and adaptable approach. This includes diversifying supply chains, exploring new markets, and developing strategies to mitigate the risks associated with the trade war. It also requires a deep understanding of the economic and political dynamics at play and the ability to anticipate potential future developments.

The trade war between the United States and China is a complex and multifaceted issue with far-reaching consequences. Its unpredictable nature and the willingness of both sides to escalate the conflict create a challenging environment for the global economy. Navigating these uncertainties requires careful planning, strategic decision-making, and a deep understanding of the evolving economic landscape.

The long-term effects of the trade war remain to be seen, but it is clear that it will have a lasting impact on the relationship between the United States and China and on the global economy as a whole. The need for a resolution that addresses the underlying issues and promotes fair and sustainable trade practices is more critical than ever.

Ultimately, the trade war serves as a reminder of the interconnectedness of the global economy and the importance of international cooperation in addressing shared challenges. Finding a path forward that benefits all stakeholders will require a commitment to dialogue, compromise, and a shared vision for a more prosperous and stable future.

✦ Tanya AI